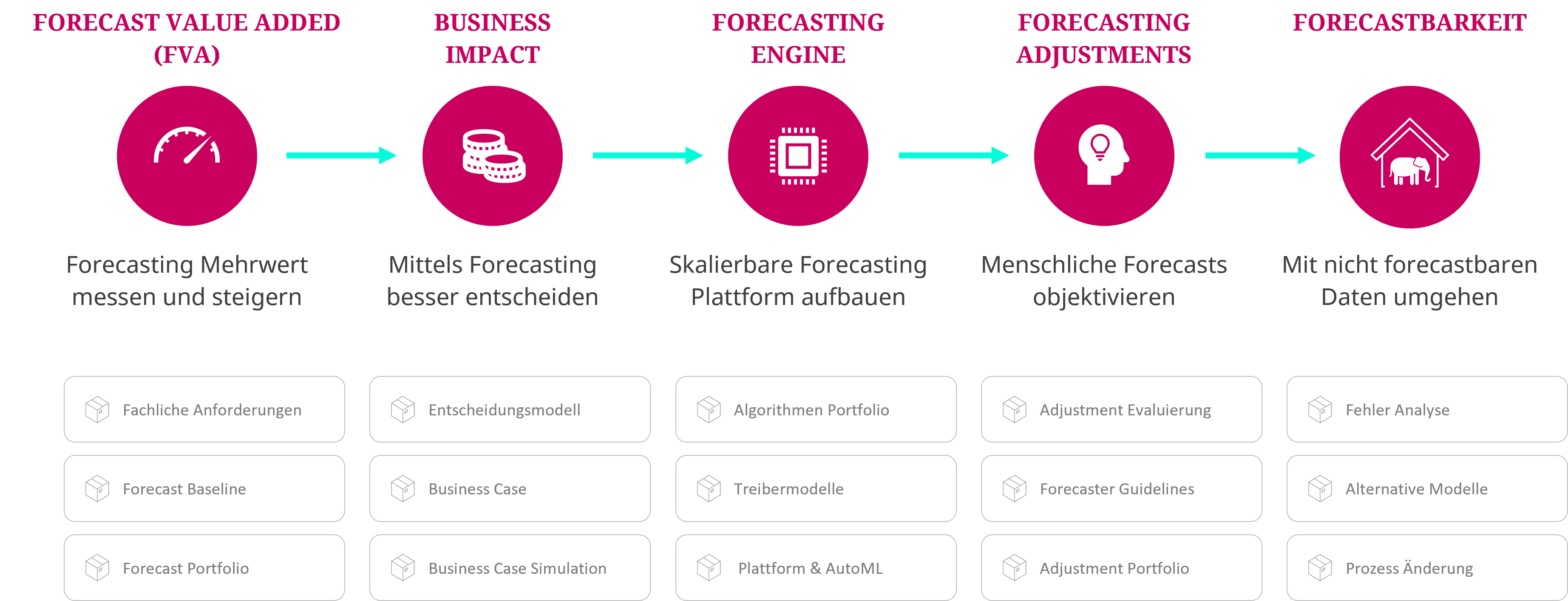

The demand forecasting process is often associated with high resource expenditure and costs - but not infrequently it leads to suboptimal results. In many cases, this leads to an unsatisfactory return on investment (ROI) of forecasting for companies. However, forecasting remains an indispensable part of planning and has a direct impact on key metrics such as logistics and inventory costs. Optimized forecasting has proven positive effects on inventory and working capital, for example. Here we present five levers for optimizing your forecasts.

01/05

The hypothesis is: Forecasting is a waste of time until proven otherwise. This is because studies with companies show that more than 50% of the common forecasting methods lead to worse results than "naïve forecasting", i.e. simply carrying forward the data from the previous period (cf. Morlidge 2019). Forecasts therefore create value for planning, just as they sometimes destroy value for planning!

FVA is a system that precisely measures which steps in the forecasting process create added value. For each individual step, a baseline is defined as a benchmark against which the added value can be quantified.

02/05

The goal of forecasting is not to achieve the highest possible accuracy. Rather, the goal is to better decisions are made. The following applies: The more important a market, a customer or a product is, the greater the impact of the respective decisions. For particularly important customers, products or markets, therefore, a step-by-step Forecasting Business Case be defined.

Based on this business case, you then carry out simulations that provide information about the costs incurred in each case. These include, for example, the respective warehousing and disposal costs, but also opportunity costs due to lost sales, which arise in scenarios of scarce inventory.

03/05

The forecasting engine consists of the platform, models for drivers between KPIs and the portfolio of available algorithms. With a scalable forecasting engine, your company is able to generate thousands of forecasts simultaneously and determine the best forecast model. Recent studies here show that forecasting based on machine learning is increasingly outperforming common methods (Makridakis et al 2022). Keep in mind, however, that these machine learning algorithms are not an automatic panacea. They need to be systematically validated and tuned. Modern Machine Learning Operations (MLOps) practices.

04/05

Companies manually adjust their forecasts to account for circumstances and events that are not explicitly reflected in the data. These adjustment processes are accompanied by a considerable expenditure of resources. Often, these adjustments do not lead to the desired added value, but distort the results so that suboptimal decisions follow. There are several reasons for these biases: cognitive biases, emotions, politics. For example, a Optimism Bias lead to excessive stockpiling and the purchase or production of goods that ultimately cannot be sold.

A systematic approach here will help you to Adjustments to objectify and evaluate.

05/05

In some cases, forecasting is not possible with a reasonable expenditure of resources and/or does not allow reliable results to be expected. This is particularly the case in unstable or fast-growing markets. In this case, you should carry out an objective cost-benefit calculation with regard to the forecasting processes and, if necessary, switch to alternative planning methods. It may be more effective at this point to change planning processes, for example, to reduce delivery times or to be able to react to changing customer needs.

Let's talk without obligation about how you can Planning reliability and Profitability can optimize through forecasting.

Current information on Best Practices in Forecasting and planning. The Flowtap Newsletter ensures you the decisive competitive advantage.